The Covid-19 pandemic has already changed – maybe permanently—the way we all live, shop, work, learn, socialize…and much more. We are having to rethink and adapt in almost every aspect of our lives.

And our SaaS operations are no exception. The global shutdown has forced many SaaS operations to shift their focus from generating a constant stream of new business to maintaining their existing revenue base. During times like these, churn—or rather, churn mitigation—is the most potent lever for short-term survival, medium-term recovery, and long-term success.

As SaaS businesses the world round shift their attention to maintaining their existing customer bases, they are having to think about churn in a way they haven’t before. And because of this, we think that a new skill set – a new competency – will emerge.

Churn forecasting.

Like for real. If they are paying attention, many SaaS businesses will come out of this crisis with a much more robust churn forecasting practice.

Why do we need a churn forecasting framework?

Raise your hand if your company forecasts monthly sales.

Ha. A bit of a rhetorical one there. 😁

OF COURSE your company forecasts monthly sales. In fact, I bet you spend hours on it each and every month. You likely have forecasting models built into your CRMs, weekly meetings across the sales organization to project the likelihoods of converting current deals, weekly updates at the exec level, real-time model adjustments, and more. You have probably built an entire infrastructure to help you accurately forecast monthly sales.

So, why don’t we apply a similar rigor to monthly churn forecasting? Let’s be honest…up until this point, the way you forecasted churn was to drag a simple, consistent churn rate across your spreadsheet like so:

Maybe you go one better and have a churn model that applies a different churn rate against account types (small, mid, large) given their different churn profiles. If so…bravo. You’re ahead of most.

But the reality is that not many teams put much more rigor than this in forecasting their monthly churn. And truth-be-told, that might have been fine for a lot of companies up until this point. Under normal circumstances, you may not have had a lot of variability in your churn rate.

But these ain’t normal times, Toto.

This pandemic and unprecedented global shutdown is will most definitely affect your churn rates. And in ways that are far from normal. It is essential to take a truly hard look at the way you project churn – in a way that can not only help provide some visibility over the next few months, but in a way that can extend beyond this shock and provide much more clarity into your business going forward.

And the basis for any good churn forecasting model is product engagement.

Four steps to designing churn forecasting model

A solid churn forecasting model should be designed in the same way you build a sales forecasting model. Traditional sales forecasting models are based on a simple formula:

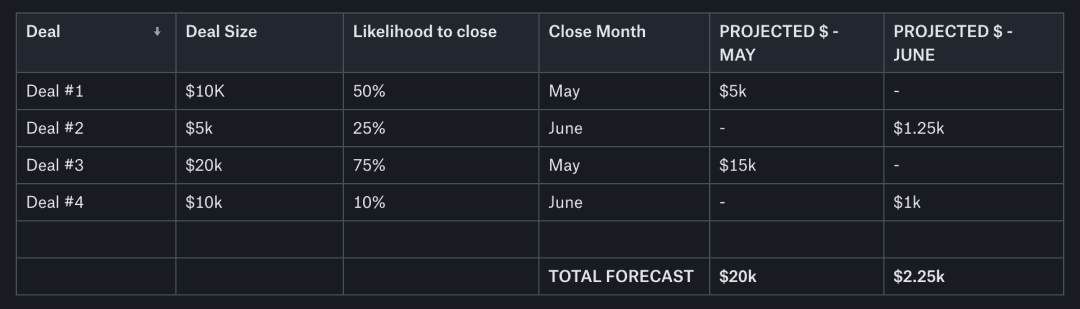

Deal size (potential $$) X Likelihood to close = FORECASTED REVENUE

Add a close date to this model and you’ve got the building blocks of a forward-looking sales model:

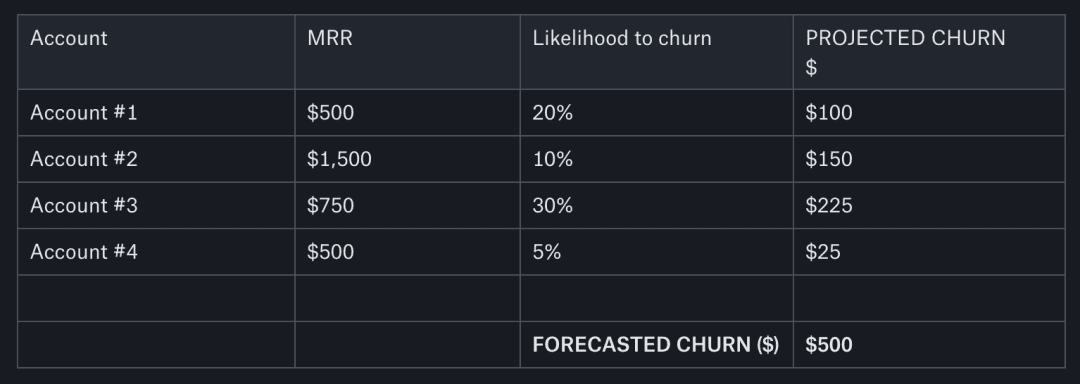

The same model can be applied to churn forecasting:

Account size (current MRR) X Likelihood to churn

Easy, right? 😉

Of course, whether you are forecasting sales or churn, the biggest challenge is figuring out a good way to calculate the “Likelihood” factor.

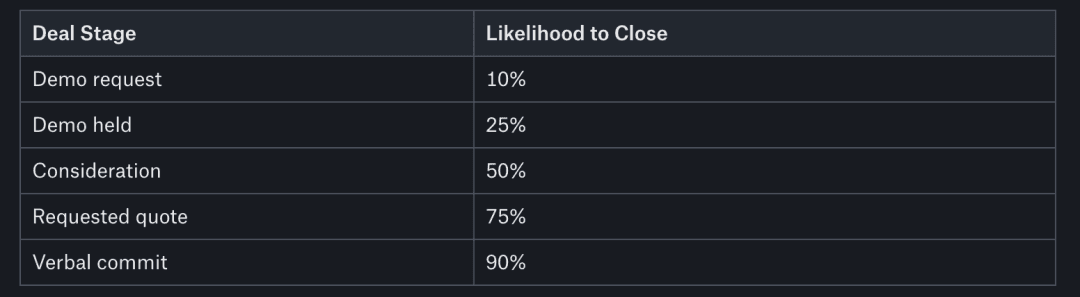

In traditional Sales forecasting, “Likelihood” is typically based on the “stage” of a deal. For example:

Of course there are more complex and nuanced versions of this model, but this is the basic framework (of course it doesn’t work well for product-led businesses – here is an alternative methodology for forecasting sales in a product-led business).

That leaves us with the question – how do you create a “Likelihood” factor for churn? How do you assign a risk factor to each of your existing accounts so that you can accurately forecast a monthly churn number?

This is the crux of designing a churn forecasting model. The four steps to building this model include:

Understand churn indicators;

Track these indicators closely;

Create top “risk” cohorts and assign a churn likelihood factor to each cohort;

Plug likelihood factors into revenue forecasting model.

Step One: Understand churn indicators

When it comes to churn, there is no greater indicator than product engagement (or, more accurately, lack thereof). Some of the most common reasons SaaS accounts churn inc

Never got to first value before buying

Never was able to figure out how to integrate the product into business process

Bad fit – didn’t have a high-value use case

Key user left the company

Found a competitor that better solved their problem

Problem issues (bugs, performance, etc)

Budget cuts

Went out of business

Maybe with the exception of Budget cuts (which sometimes do come seemingly out-of-the-blue), every one of these reasons will be expressed through a product engagement metric or indicator.

For example, if the account was never able to get to first value, they will have a low Activation rate. in their first few months with the product.

If a key user leaves a company, the account’s overall engagement will drop significantly.

If the users found a competitive product, their engagement will drop over a period of time (when they are assessing the other solution) and they may eventually trigger some key event that would indicate they are ready to leave (like export data, or disconnect integrations, etc).

The first step in creating a churn forecasting model is understanding engagement-based churn indicators. As mentioned above, there are many reasons why accounts cancel their subscription, but they will all be expressed by some engagement metric. These include:

Low Activation: Activation is a measure of how far an account has gone down the path of becoming “Activated.” A paying account with low Activation rates is an indication of an account that hasn’t been properly onboarded and therefore may be missing some key value of the platform – which could lead to early cancellation.

Low Engagement: An account with low engagement levels is certainly more likely to churn than an account with higher engagement. But if that low level of engagement is relatively consistent, it may not be a major risk.

Significant drop in Engagement: An account that shows a significant drop in engagement over time is a bigger red flag than consistent levels of low engagement. There can be many reasons why an account’s engagement would drop overtime (including some of the reasons mentioned above) – none of them very good.

Inactivity: Low engagement is one thing. NO engagement is another – and one that carries a much higher churn likelihood. An account that has been inactive for 7 days it not good. An account that hasn’t been active for more than 30 days is a real problem.

Triggered farewell event: In some products, there are certain activities that users do when they are preparing to close down the account (like exporting data, or removing a key integration, or deleting templates, etc). We call these “farewell” events.

Step Two: Track these indicators

Admittedly, this might be the hardest step in this exercise. To be honest, it’s precisely why we built Sherlock. If you are a Sherlock user, tracking these metrics will be easy and second nature. If not, then you will need to have an internal system to track and calculate these important metrics for all of your paid accounts. You can learn more about building an engagement scoring system in this post if this is something you want to build internally to support this effort. If you don’t, you can try to build some kind of proxy for engagement. The important part is to be able to measure both engagement and activation (and they are different) separately.

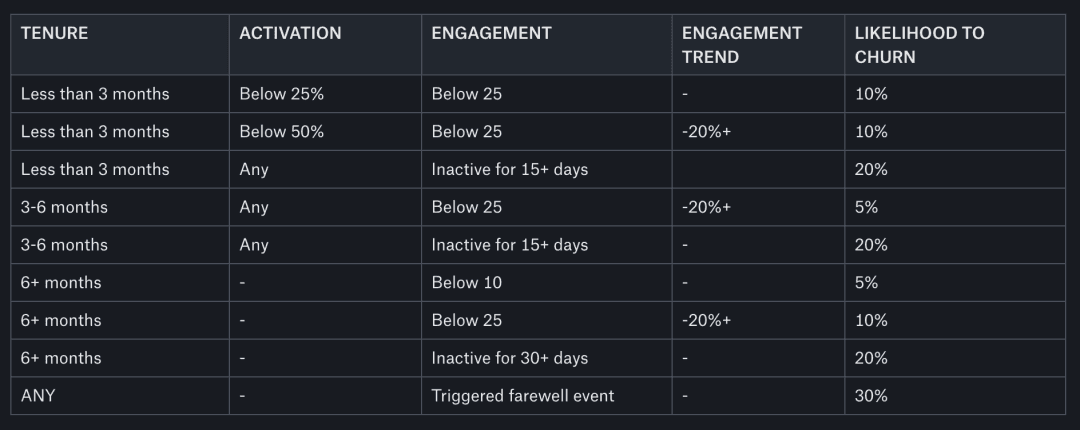

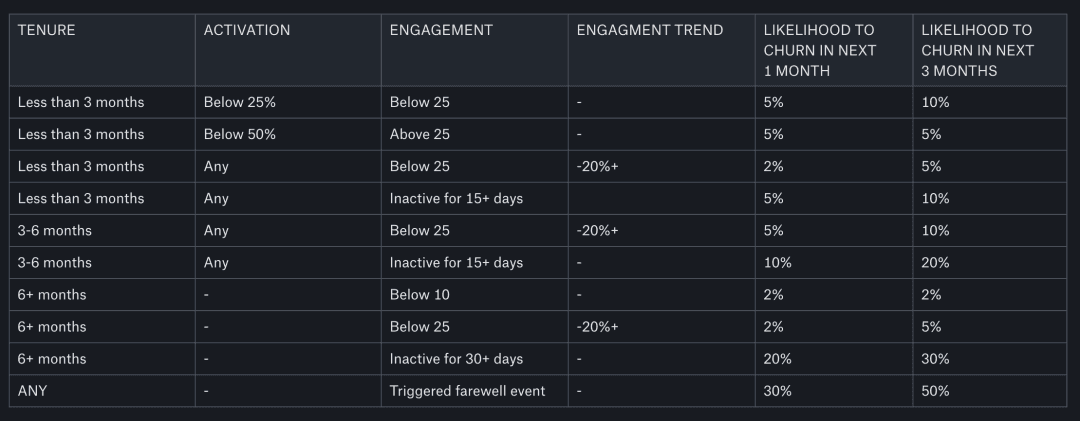

Step Three: Create your top “risk” cohorts

With these engagement indicators in mind, the next step is to put together a churn likelihood model that creates different churn threat segments and assigns a respective likelihood factor to each. Generally, we recommend creating these segments with account tenure in mind. Accounts engage with your product differently based on how long they’ve been using the product and therefore should be treated differently in any kind of churn forecast model.

Your churn likelihood model will look something like this:

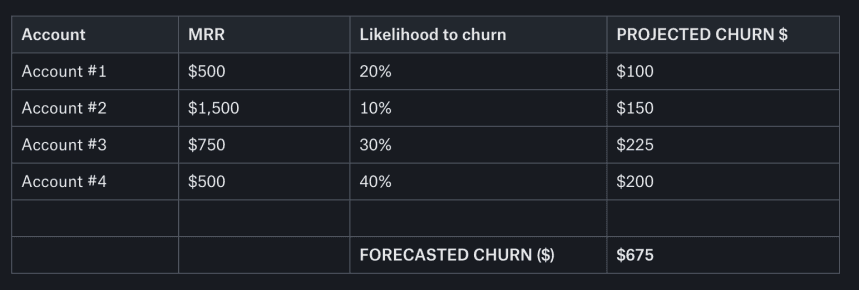

Step Four: Combine likelihood factors with MRR for each account

Once you have likelihood estimates in place per segment, you can plug them into your larger forecasting model (shown earlier) – accounting for the MRR of each account:

Et voila! You’ve got a churn forecast model based on account engagement!

Looks awesome – but how do I set this up??

I know, I know. This sounds like a lot. But don’t worry. So long as you have a solid handle on your key engagement metrics for each account, you can absolutely build a solid model without a PhD in machine learning (or any machine learning at all – trust me!).

Start by looking at the last X number of churned accounts. Let’s call it the last 3 months to start. Some of this historical data will be difficult to get (even with Sherlock), so alternatively you could just commit to tracking churned accounts over the next 1-3 months. These accounts will serve as the basis of your model.

For each churned account, look at the engagement indicators from your model. You will start to understand which indicators are more consistently correlated with an account cancelling. This is a very iterative process so spend time setting up an initial model – knowing that it will evolve overtime. Play with it and use it to forecast churn in your third month. See how accurate you are. I think you will surprise yourself.

What about timeframe? Should I only forecast one month out?

This is a really good question and it’s really up to you how far out you want to look. Like with any forecasting, it’s often harder to be accurate with a forecast in a very small window – like one month out – and easier if you use a slightly wider one – like 3 months out. Anything beyond that is really planning (versus forecasting).

We recommend a forecasting model that covers both short-term churn (1 month) and a mid-term window (3 months). Simply append your likelihood model with columns for “likelihood of cancelation in next 1 month, next 3-months” and adjust your “likelihood” rates to each time frame. For example, an account that is inactive for 7 days might not be likely to cancel this month, but might have a 10% likelihood of cancelling the following month.

What if I sell annual contracts?

This type of model works the same with annual or monthly contracts. If you sell only annual contracts, simply apply the model against those accounts whose contract is scheduled to renew within the next three months. This will give you a very good indication which contracts are at risk.

With that said, with an annual contract model, it is likely someone from your team will be in touch with account as contract renewal approaches. The direct feedback from the account (ie – “We’re not going to renew this contract”) may override the “likelihood factor” in this kind of engagement model.

Not an exact science - but incredibly accurate

No forecasting is an exact science. Churn forecasting is no exception. But when you have the proper, detailed visibility into how your accounts are engaging (or not engaging) with the product, you can build a model that is incredibly accurate and gives you essential transparency into this key metric.

Don’t consider this post an exact formula for how you should be using product engagement to forecast your churn. Our goal is to encourage you to start thinking about churn forecasting more seriously – and to put product engagement data at the heart of it. The specifics of how you do it aren’t as important as the process here. Give it a shot. I promise you won’t be disappointed. In fact, you’ll wonder why you didn’t do it a long time ago.